mbardu

Well-Known Member

Did I miss another $GME thread?

I thought we'd have a fierce discussion considering how many boomers we have here

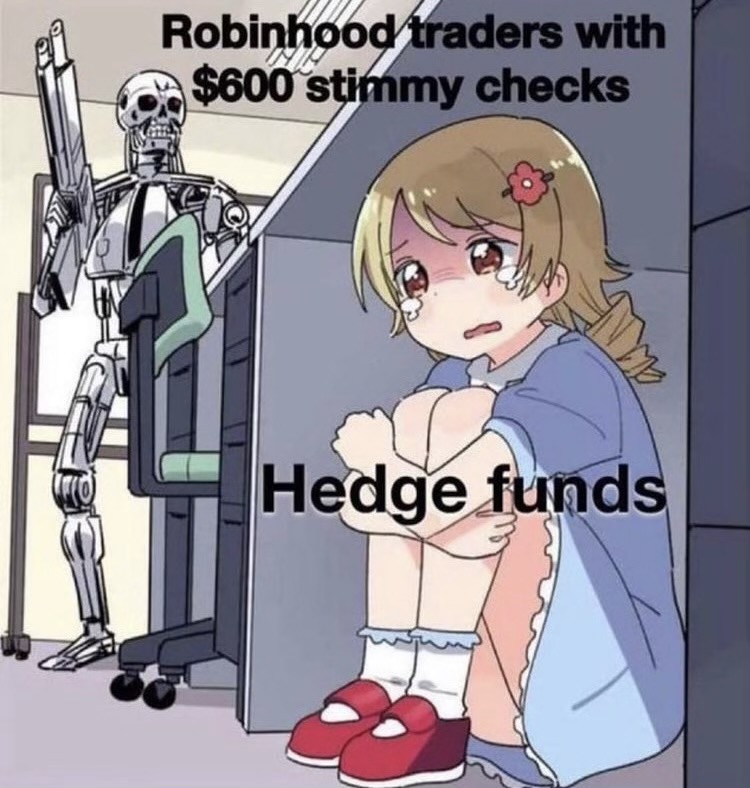

Anyway, are you still (how??) short the stock?

Are you long in shares on the rocketship?

Are you pissed off to see the blatant media manipulation to blame "market disfunction" on a shit-posting subreddit while nobody bats an eye that hedge funds were (probably illegally) shorting 140% of the stock's float?

Anyway...

Discuss

I thought we'd have a fierce discussion considering how many boomers we have here

Anyway, are you still (how??) short the stock?

Are you long in shares on the rocketship?

Are you pissed off to see the blatant media manipulation to blame "market disfunction" on a shit-posting subreddit while nobody bats an eye that hedge funds were (probably illegally) shorting 140% of the stock's float?

Anyway...

Discuss